Understanding how your professional liability insurance premium is calculated can help you to manage your business and plan or forecast with greater confidence.

The formula is very simple and is applied equitably across all architectural practices.

As an illustration only, imagine an architectural practice had annual reported fees of $200,000, and purchased the minimum mandatory coverage of $250,000. Assume that there have been the same fees earned each of the past four years.

Fees reported for 2020 renewal: $200,000

Fees reported for 2021 renewal: $200,000

Fees reported for 2022 renewal: $200,000

Fees reported for 2023 renewal: $200,000

3-year average revenue (2020 – 2022): $200,000

3-year average revenue (2021 – 2023): $200,000

In 2022:

Premium = rate x 3-year revenue (i.e., Gross Fees) average.

For simplicity, assume that the rate charged for this practice in 2022 was exactly 4.0%. This means they would have paid [(3-year average fees) x (rate)] = $200,000 x 4% = $8,000.00 as a premium in 2022.

For example, if 3-year average revenue increases by 5% and the rate increases by 5%, the premium increase will be 10.25%, all else being equal.

In 2023 with inflation adjustment:

Premium = rate x inflation adjustment x 3-year revenue (i.e., Gross Fees) average.

In 2023, the rate increase was 5%, so it is now (4.0 x 1.05) = 4.2%. The three-year average fees will have a 4% inflationary factor applied, so the three-year average will be ($200,000 x 1.04) = $208,000. This means they will have paid [(3-year average fees) x (rate)] = $208,000 x 4.2% = $8,736.00 as a premium in 2023. This new premium reflects the rate increase of 5% and the impact of the inflation adjustment of 4%.

The difference in premium between 2022 and 2023 is an increase of $736.

As your architectural practice grows, so too will your mandatory limits of liability, and consequently, your premium.

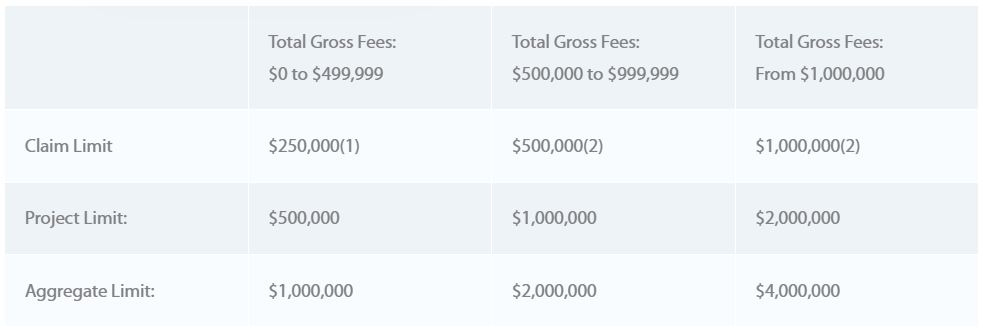

For example, when reported fees are over $500 K or above $1 M, the mandatory Claim, Project and Aggregate Limits increase, commensurate with your firm’s growth (see the chart below). The jump to the next tier up, also triggers an increase in premium.

Should you require a more detailed explanation specific to your firm, please don’t hesitate to reach out to our Underwriting team after you’ve received your renewal package.