Pro-Demnity will no longer provide unlimited Claims Expenses and defence costs when Excess Insurance is purchased outside the Pro-Demnity program.

This change has important consequences for architects purchasing Excess Insurance from other insurers. The reasoning behind the changes is provided below, and the amendments to the Pro-Demnity Policies implementing this change are provided as Appendices to this Notice.

Architects who purchase Excess Insurance from

companies other than Pro-Demnity should be sure to share this Notice and the Appendices with their broker.

An endorsement to the Excess Policy providing coverage for Claims Expenses above Pro-Demnity’s cap is essential for your protection.

Why is the change required?

Since a 2013 court decision, a provider of an Excess Insurance policy has no obligation to contribute anything at all to defence costs, unless the Excess Policy includes a “Duty to Defend” provision. In the wake of the court decision in 2013, a Claims Expense Limit of $200,000 was implemented where an architect purchased Excess Insurance from another insurer above the then mandatory limit of $250,000 per claim.

In 2016, the mandatory Claim Limit under the Architects Act was adjusted to provide three levels up to $1,000,000, although no change was made to the cap on Claims Expenses for the higher mandatory limits.

In the past ten years, the ratio of Claims Expenses – legal defence costs, investigations and experts’ fees which Pro-Demnity is required to fund – to settlement costs has increased by 233%. This staggering increase in Claims Expenses has been a major factor impacting Pro-Demnity’s costs and premiums.

Since Pro-Demnity did not provide these Excess Policies, it received no compensation in the form of premiums. The Excess Insurer was only obliged to share in the costs of settling a claim when a) the damages actually paid exceeded the Pro-Demnity Claim Limits and b) the Excess Policy included language that it would contribute to the damages. Even when the Excess Insurer did contribute to the damages, it was typically on a pro-rata basis, and only at the end of a lengthy settlement process.

Until now, Pro-Demnity has funded the defence – often for years – without assurance of any recovery, and the Excess Insurer benefitted when Pro-Demnity’s defence successfully protected the Excess Insurer from paying damages. Pro-Demnity’s funds are your funds. Good business practice and fairness to Ontario architects dictates that we not indirectly finance the activities of competing insurers.

No impact on architects purchasing Increased Limits from Pro-Demnity

Pro-Demnity will continue to honour its commitment to defend claims against our policyholders without subtracting the Claims Expenses from the Claim Limit. Architects who purchase Mandatory Limits, or Mandatory plus Increased Limits from Pro-Demnity will continue to enjoy unlimited protection covering Defence Costs and Claims Expenses.

When will this happen?

The Policy amendments will take effect on July 1, 2019, three months after the date of this Notice. This should allow sufficient time for any policyholders purchasing excess coverage to instruct their brokers to make the necessary changes to their coverage. Failure to do so may result in the architect absorbing Claims Expenses in excess of the Pro-Demnity cap from their own resources.

These changes will be effective on renewal of a policyholder’s existing insurance through Pro-Demnity. It is important that the Excess Insurance reflect the changes on this date, so that the policyholder’s Excess Insurance coverage is coordinated with their Pro-Demnity Policy.

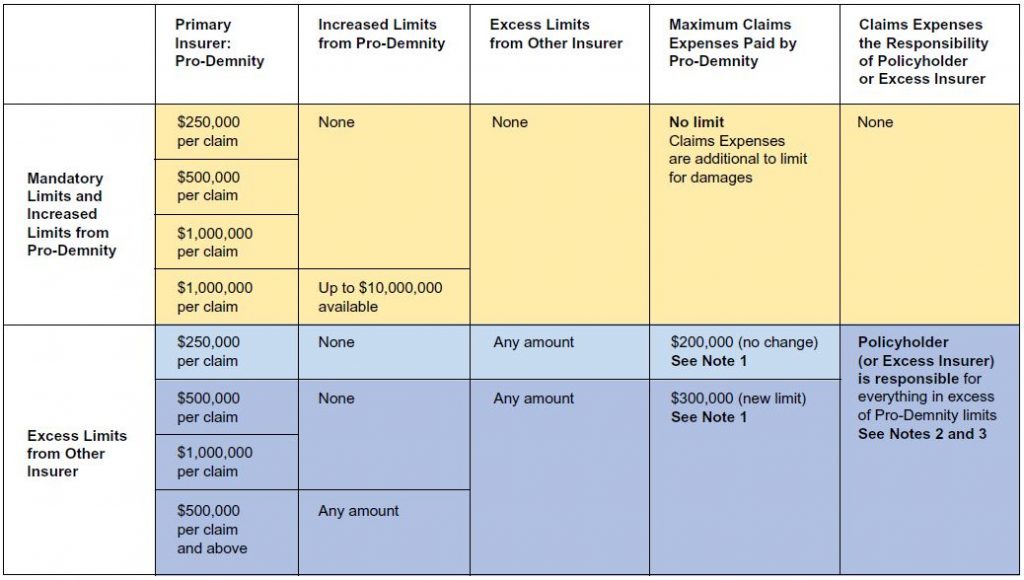

The accompanying chart and notes illustrate the impact of this change.

Refer to the wordings of the Amendments to the applicable Policies, Policy No. 1 and Policy No. 4, below.

Amended wordings the applicable Policies.

Responsibility for Claims Expenses

Notes

1.If you purchase Excess Insurance, be certain to review with your broker the limits on Pro-Demnity’s share of Claims Expenses, as shown on the chart. For your own protection, insist that any such Excess Insurance must include coverage for all Claims Expenses above this limit – initially, and at each renewal. An endorsement on the Excess Policy is essential to ensure that you are protected.

2. Pro-Demnity’s obligation to pay your Claims Expenses ceases when the maximum defence costs shown on the chart have been exhausted. You or your Excess Insurer are responsible for the payment of any Claims Expenses thereafter.

3. Where Claims Expenses are “included” within the Excess Policy limits of liability, “included” actually means that any defence costs, investigation costs or legal and experts’ fees will be taken from the funds available for eventual payment of damages on your behalf by your Excess Insurer. So you may need to purchase even higher Excess Limits to maintain the coverage payable for damages required by you or your client, in order to obtain protection equivalent to Pro-Demnity’s Increased Limit.

Terminology

Duty to Defend: broader than the duty to indemnify; the obligation to provide a defense of allegations covered by the liability insurance policy – even if the coverage is in doubt and if ultimately, no damages are awarded.

Mandatory Limits: the minimum limits prescribed by the Architects Act and Regulation. These currently range from $250,000 per claim, $500,000 maximum for one project, $1,000,000 aggregate for all claims within the Period of Insurance (annually); up to $1,000,000 per claim, $2,000,000 maximum for one project, $4,000,000 aggregate for all claims within the Period of Insurance.

Claims Expenses: all costs incurred to investigate, defend, and settle a claim, including in particular, fees for lawyers, experts, mediators and court costs – also referred to as Defence Costs.

Increased Limits: any amount of higher limits, beyond (or “above”) the Mandatory Limits, purchased through the Pro-Demnity Increased Limits program.

Excess Insurance: any amount of higher limits, beyond (or “above”) the applicable Pro-Demnity Mandatory Limits purchased from an Excess Insurer, i.e., a provider other than Pro-Demnity.

Amendments to Policy No. 1 (i.e., policies issued for the minimum mandatory Claim Limit of $250,000)

A Claims Expense Limit of $200,000 continues to apply to policyholders purchasing Excess Insurance above the minimum mandatory Claim Limit of $250,000 through Pro-Demnity.

New Wording

PART II: YOUR INSURANCE

- THE INSURER’S OBLIGATIONS

c. SUPPLEMENTARY PAYMENTS

i. THE INSURER will pay, for each CLAIM, the following:- CLAIMS EXPENSES, provided that in the event YOU become liable to pay DAMAGES arising out of a CLAIM in an amount that exceeds the amount set out in the Certificate of Insurance under CLAIM Limit of Liability, THE INSURER’s obligation to pay YOUR CLAIMS EXPENSES shall be limited to an amount that is calculated by multiplying the total CLAIMS EXPENSES by the amount set out in the Certificate of Insurance under CLAIM Limit of Liability and dividing the product by the DAMAGES YOU are required to pay, unless YOU have specifically arranged professional liability insurance that applies as excess to the insurance provided by this POLICY. In that event, the maximum amount THE INSURER will pay as CLAIMS EXPENSES incurred by THE INSURER to investigate, defend, settle, arbitrate or litigate a CLAIM covered by this POLICY, is $200,000, even if the limits under the professional liability insurance that you have specifically arranged to apply in excess to the insurance provided by this POLICY have been eroded or exhausted;

- Post-judgment interest upon that part of a judgment which falls within the remaining Limits of Liability at the time.

Changes to wording are highlighted in colour. There are no other changes to Policy No. 1.

Amendments to Policy No. 4 (i.e., policies issued for Claim Limits above $250,000)

New Wording

PART II: YOUR INSURANCE

- THE INSURER’S OBLIGATIONS

c. SUPPLEMENTARY PAYMENTS

i. THE INSURER will pay, for each CLAIM, the following:- CLAIMS EXPENSES, provided that in the event YOU become liable to pay DAMAGES arising out of a CLAIM in an amount that exceeds the amount set out in the Certificate of Insurance under CLAIM Limit of Liability, THE INSURER’s obligation to pay YOUR CLAIMS EXPENSES shall be limited to an amount that is calculated by multiplying the total CLAIMS EXPENSES by the amount set out in the Certificate of Insurance under CLAIM Limit of Liability and dividing the product by the DAMAGES YOU are required to pay, unless YOU have specifically arranged professional liability insurance that applies as excess to the insurance provided by this POLICY. In that event, the maximum amount THE INSURER will pay as CLAIMS EXPENSES incurred by THE INSURER to investigate, defend, settle, arbitrate or litigate a CLAIM covered by this POLICY, is $300,000, even if the limits under the professional liability insurance that you have specifically arranged to apply in excess to the insurance provided by this POLICY have been eroded or exhausted;

- Post-judgment interest upon that part of a judgment which falls within the remaining Limits of Liability at the time.

Changes to wording are highlighted in colour. There are no other changes to Policy No. 4.

Be sure to share this with your broker. An endorsement to the Excess Policy providing coverage for Claims Expenses above Pro-Demnity’s cap is essential for your protection.

To download a PDF of the above, click on the 3 ellipses in the menu bar of the flip book below, and select “Download PDF file.”