The Straight Line Newsletter — Issue #12

Pro-Demnity Presents Joanne McCallum as Chair The Pro-Demnity Board is pleased to introduce chair, Joanne McCallum, OAA, FRAIC.

Joanne joined the Pro-Demnity Board in 2017 and was elected Chair in February 2020. Her previous support to the architectural profession includes service on OAA Council; a term as OAA vice president, internal affairs, and chairing the OAA Practice Committee. She was also a six-year board member of CaGBC.

Next year, Joanne will help celebrate the 25th anniversary of mcCallumSather in Hamilton, Ontario, a firm which she co-founded with Greg Sather in 1996, and of which she is currently CEO. The firm was an early advocate of sustainable design, and has championed these principles, nationally and internationally, since its inception.

Joanne’s dedication to the natural environment, as well as her down-to-earth business approach can be traced to her childhood, spent in Kincardine, Ontario, where her firm now has a second office. This love of nature continues to be shown in her leisure passions, like skiing, sailing and scuba diving. Her pragmatic values are evident in some of her other favourite things, such as healthy debate, mentoring young professionals, strategic planning and a good game of euchre.

— The Editor

Risk Management Challenges: Two risks you can avoid now.

Ontario architects have turned to Pro-Demnity for risk management advice since 1987. The initial sources of this advice were the Claims Managers, with the support of David Croft’s popular Claims Stories.

As part of our support tripod – Underwriting, Claims Handling and Risk Management – Pro-Demnity has, since 2005, continually expanded its Risk Management program to include province-wide Loss Prevention events, Bulletins, Notices, issue-specific advisories, research, advocacy and publications such as this newsletter.

In this issue, Pro-Demnity’s Vice President, Practice Risk Management shares two current pieces of Risk Management advice, both deserving special attention.

The Grenfell Tower revisited

In a recent TV drama series Little Fires Everywhere, fires are represented physically as destructive conflagrations, and metaphorically as destroyers of conventions and the status quo. We hardly need reminding that in recent years, our world has suffered both types of fires to an excessive degree. The world set literally on fire by climate change was our major concern until a pandemic arrived to displace it. But still smouldering in the background is the aftermath of the Grenfell Tower fire in London, England, that claimed 72 lives on the night of June 14, 2017, and continues to spark disruption in the UK and around the globe.

In earlier issues of The Straight Line (No. 6, July, 2018; No. 9, December 2019) we shared our observations on the continuing effects of the fire, in particular: How is it likely to affect architectural practice in Ontario, Canada and the world? The answer to this question and others is gradually emerging as Phase 2 of the Grenfell Tower Inquiry continues.

Where Phase 1 of the Inquiry focused on the events of the night of June 14, 2017 (Report published October 30, 2019), Phase 2, which started up in early 2020, is examining the causes of the catastrophic events, particularly, how Grenfell Tower arrived at a condition that allowed the fire to spread, as identified in Phase 1. The second phase, interrupted by COVID-19 protocols, was resumed in July, and as it progresses, important repercussions are already being felt.

The disclosures arising in Phase 2 have not been good news for any participants. Evidence relating to the project’s archi-tect, including the process for selecting the firm, have proven particularly damaging. Along with a number of others called to testify during Phase 2, the architect sought and was eventually granted immunity from criminal prosecution, respecting evidence provided to the Inquiry. The firm has since gone out of business.1

This is in addition to other serious accusations of irregular, dishonest, secretive, abusive, negligent, possibly unprofessional and even criminal behaviour, on the part of several firms and agencies associated with the project. One witness told the Inquiry that the firms involved were “little more than crooks and killers.”2 Grenfell illustrates the catastrophe that ensues when, through a cascade of errors and omissions, hardly any of these precautions are taken.

Among the determinations and revelations that have emerged so far:

- In 2018, the relevant building regulations in the UK were hastily amended – then re-amended in November, 2019 – banning the use of combustible materials in or on the external walls of residential and other classes of buildings over 18 metres.3 This regulation seems eminently sensible, but it may soon be followed by a second stringent regulation that could dampen worldwide enthusiasm for a current construction trend: “The government of England could be reducing the maximum height of wood-framed buildings from six storeys to three or four to avoid another Grenfell Tower Fire.”4 What does wood framing – or indeed tall timber – have to do with aluminium cladding panels? Both employ flammable materials, but are permissible provided that critical precautions are taken to avoid flame intensity, duration and spread. Grenfell illustrates the catastrophe that ensues when, through a cascade of errors and omissions, hardly any of these precautions are taken. Two further questions arise. What happens before the precautions are in place – during construction, for example? And what happens if these precautions are not maintained?

- “[A]n alliance of more than 80 organ-isations has agreed on a set of fire safety standards that can be applied to buildings anywhere in the world.”5 According to Warta Saya, an ABC Malaysia website, the International Fire Safety Standards (IFSS) Coalition consisting of an international group of construction, architecture and fire safety professionals, established in the wake of the Grenfell Tower fire, will establish “minimum levels of safety throughout the world in both developed and developing nations.”

- As a forewarning of what could easily become an international insurance crisis, architects in the UK are already feeling the pinch, with some architects having difficulty finding professional liability insurance, and others seeing premium hikes by as much as 800%6— in a competitive, non-mandatory insurance market.

There is already a great deal of uneasiness among architects, constructors and insurers, worldwide, regarding buildings with exterior panels identical or similar to those used in Grenfell Towers that are already completed and inhabited. In the UK alone, in June 2019, it was estimated that, of 328 buildings with aluminium composite material (ACM) cladding, 221 were still awaiting remediation work to start.7

Notes

- https://www.paintsquare.com/news/?fuseaction=view&id=22489

- https://www.itv.com/news/london/2020-11-09/grenfell-tower-revamp-firms-little-more-than-crooks-and-killers-inquiry-hears

- http://www.legislation.gov.uk/uksi/2018/1230/regulation/2/made

- https://www.constructioncanada.net/u-k-plans-to-reduce-height-of-wood-buildings-to-avoid-another-grenfell/

- https://wartasaya.com/2020/11/05/grenfell-fire-leads-to-global-safety-standards/

- https://www.architectsjournal.co.uk/news/insurance-hikes-of-as-much-as-800-per-cent-hit-architects-hard?blocktitle=news-feature

- https://www.bbc.com/news/uk-england-4860959

The Canadian Law of Architecture and Engineering: Third Edition

Beverly M. McLachlin, Arthur M. Grant.

Toronto: LexisNexis, 2020

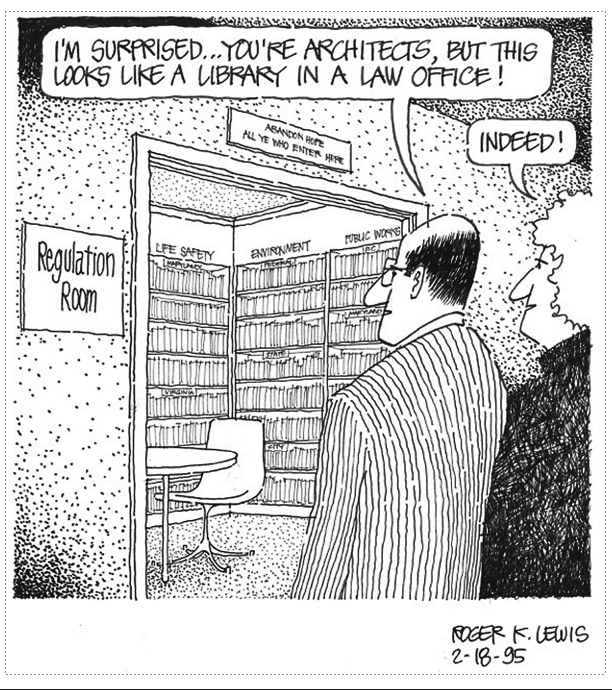

There are many laws that architects need to be familiar with – bylaws, building codes, codes of ethics, business regulations, structural principles, design rules, to name a few. It seems only fair to leave common law, tort law, statute law and contract law to the specialists: lawyers. On the other hand, a reasonable familiarity with the laws that impact the practice of architecture doesn’t seem too much to expect of a professional.

The Canadian Law of Architecture and Engineering: Third Edition won’t tell you all you need to know about Canadian law, but it will make you much better informed when you review contracts, deal with clients and contractors, or call to discuss your problem with the OAA, Pro-Demnity or your own lawyer.

The Right Honourable Beverley M. McLachlin, former Chief Justice of the Supreme Court of Canada has co-authored three editions of The Canadian Law of Architecture and Engineering. The first edition, co-authored with W. J. (Bae) Wallace was published in 1987; the second, co-authored with Wallace and Arthur M. Grant, was published in 1994. After a 25-year hiatus, including the 17 years when Ms. McLachlin served as the Chief Justice of the Supreme Court, the third edition of this definitive text, co-authored by McLachlin and Grant, became available in June 2020. Watch The Straight Line for future articles based on the contents of this book.

Our Contributor

John C. A. Hackett B. Arch, OAA, FRAIC

John is the Vice President Practice Risk Management for Pro-Demnity Insurance Company. In that role he is the “voice on the phone” and respondent to e-mails from architects seeking assistance with concerns related to liability and professional liability insurance. He has served as the moderator for many seminars and events sponsored by Pro-Demnity, and has authored many of Pro-Demnity’s “risk management” advisories. John is a 1967 graduate of the University of Toronto School of Architecture. Prior to joining Pro-Demnity he was a long-serving principal with Carruthers Shaw and Partners Architects in Toronto.

John can be contacted at Pro-Demnity headquarters:

200 Yorkland Blvd, Suite 1200 Toronto, ON M2J 5C1

Tel: 416 386-1770 Ext. 259

johnh@prodemnity.com

The Straight Line is a newsletter for architects and others interested in the profession. It is published by Pro-Demnity Insurance Company to provide a forum for discussion of a broad range of issues affecting architects and their professional liability insurance.

Publisher: Pro-Demnity Insurance Company

Editor: Gordon S. Grice

Design: Finesilver Design + Communications

Address: The Straight Line c/o Pro-Demnity Insurance Company 200 Yorkland Boulevard, Suite 1200 Toronto, ON M2J 5C1

Contact: editor@pd-straightline.com

Pro-Demnity Insurance Company is a wholly owned subsidiary of the Ontario Association of Architects. Together with its predecessor the OAA Indemnity Plan, it has provided professional liability insurance to Ontario architects since 1987.

Questions related to the professional liability insurance program for Ontario architects may be directed to Pro-Demnity Insurance Company. Contact information for the various aspects of the program can be found on the Pro-Demnity website: www.prodemnity.com

Pro-Demnity Insurance Company makes no representation or warranty of any kind regarding the contents. The material presented does not establish, report or create the standard of care for Ontario architects. The information is by necessity generalized and an abridged account of the matters described. It should in no way be construed as legal or insurance advice and should not be relied on as such. Readers are cautioned to refer specific questions to their own lawyer or professional advisors. Letters appearing in the publication may be edited.

Efforts have been made to assure accuracy of any referenced material at time of publication; however, no reliance may be placed on such references. Readers must carry out their own due diligence.

This publication should not be reproduced in whole or in part in any form or by any means without written permission of Pro-Demnity Insurance Company. Please contact the publisher for permission: publisher@pd-straightline.com